Financial Advisor Briefing

Skoufis' Strategy Stands Out In A Sea Of Advisors

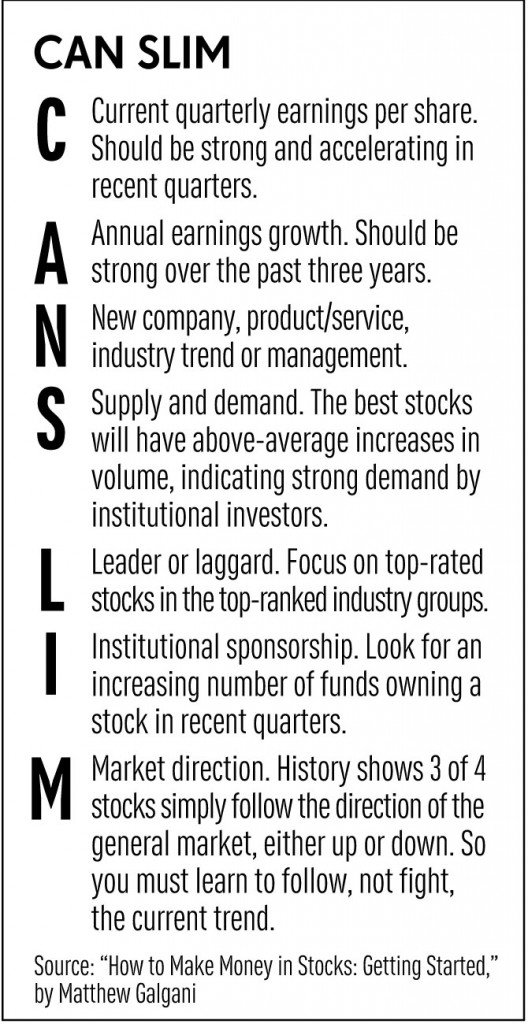

Peter Skoufis employs a CAN SLIM strategy for his business.

- NANCY GONDO | 2/19/2016

Modern portfolio theory, which seeks to maximize expected return and minimize risk with a diversified portfolio, still looms large in the financial advisor universe.

But Peter Skoufis has taken a different approach in building his financial advisory business. He selects stocks using CAN SLIM principles and has the ability to be fully invested or 100% in cash when the market is heading sharply south.

"Unless you have a strategy you're implementing, most folks do take a passive approach," Skoufis, chief investment officer at Skoufis Capital Management, told IBD. "I think active investing is beneficial in any market. Even when the markets are doing well, active investing can get you into the best performers if you have a concentrated basket of the best-performing stocks."

Skoufis recently moved his business to Chicago from Milwaukee to broaden his client base and educate investors who may not be familiar with the benefits of CAN SLIM, the investment system developed by Investor's Business Daily founder and Chairman William O'Neil.

Best Stocks To Invest In

"I love working with CAN SLIM because it puts my clients in the best-performing stocks and protects them during market downturns," Skoufis said. "Using CAN SLIM is a way to differentiate my business from the vast investment world and provides a unique and differentiated approach to investors looking for another way to handle a very tumultuous investment landscape."

For instance, he began moving into cash in December as he locked in gains and cut losses amid the market downturn. He followed his 7% loss-cutting rule and was out of the market for much of the stock market correction. And his clients aren't complaining.

Skoufis gained attention as a UBS stockbroker in 2008 when the Nasdaq composite and S&P 500 sank a respective 41% and 38%. Using CAN SLIM helped him avoid the crash, and he instead wrapped up the year with a 2% return. In 2013, he snared a 59% return, outperforming the S&P 500 and Nasdaq's 30% and 38% respective gains.

"I remember walking into my office at UBS in 2008, and everybody was panicking," he recalled. "Passive (investing) becomes very difficult during those times, and you really have to have a longer-term approach. I think it’s really important for folks that are getting closer to retirement to consider having some sort of assets in active, because they may not have 10 or 15 years to hold through the next longer-term bear cycle down."

He launched his portfolio management career in 2005 at A.G. Edwards in Milwaukee and has been CAN SLIM certified since 2007. After trading on his own for a few years, he approached the investment firm and told the hiring manager he wanted to build a business around Investor's Business Daily. After moving to UBS and running the strategy there for about three years, he decided to start his own niche financial advisory business in April 2011.

Cuts Stock Losses

Skoufis usually holds six to eight stock positions and prefers to take profits at 15% to 20% and wait for a new basing pattern to form. He cuts losses at 7% to protect against major broad market declines. Given the current volatility, he says, growth investors should be out of the market. They need to protect both emotional capital and their investment accounts, he advises.

"Investors may need to be prepared for a longer-term correction or bear market," he said. "With the typical bear market lasting six to eight months on average, now is a good time for investors to position themselves for the next uptrend that will eventually come. The CAN SLIM strategy will be able to flag that turning point and offer astute growth investors a fresh new group of leading stocks with strong fundamentals and coming out of proper technical basing patterns."

Skoufis educates clients on CAN SLIM investing through his website (www.skoufiscapital.com) and other materials.